Donation Invoice

Donations are mostly tax-deductible but taxpayers are not let off with just their word they need to provide proof that a particular amount. The invoice is sent usually by standard mail or e-mail and with payment being due by a specific date usually thirty 30 days.

Donation Invoice Template Author.

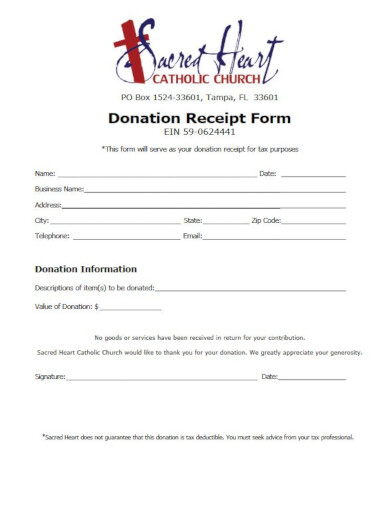

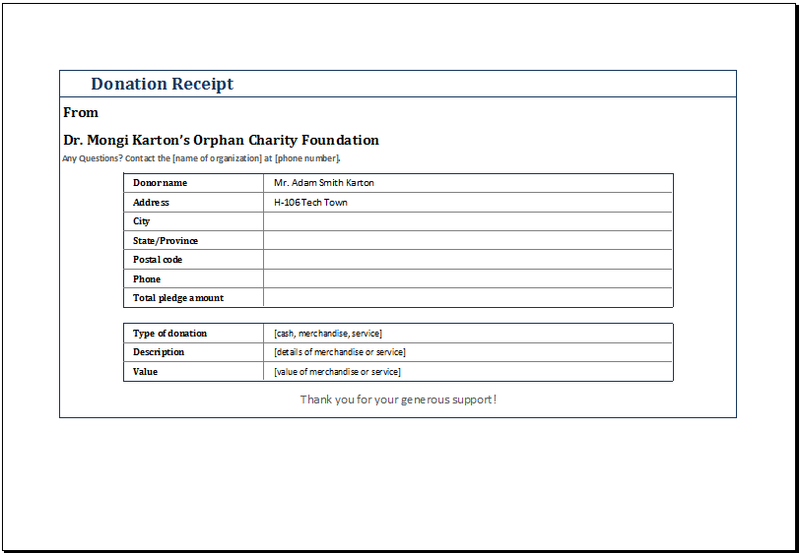

. Quick invoicing tips for non-profit organizations Include a donation due date. Include issuance date Add the donation amount Add payment method Sign the donation receipt. A donation receipt is always necessary if the donor requests one no matter the amount or value.

A donation page is the perfect place for your sales pitch. 3 replies 3K views. Download the free Donation Receipt Template from Invoice Quickly Add your non-profit organization name and basic contact details Add your logo in your favorite fonts and colors Add the donors name address phone number and email address etc.

Donation invoices sometimes called donation receipts act as proof that someone often referred to as a donor made a charitable contribution to a nonprofit charitable or similar organization. If the donation is broken up over time or for monthly or quarterly contributions you should send out the invoices accordingly. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status.

You can make donation scripts digitally or use receipt templates available online which are printable too. If there wasnt any exchange involved state this too. The date of the contribution The donors name A description of the donation Contact information such as a phone number The name of the organization.

Invoicing for donation. A donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Enter the Crucial Details The structure should be simple and understandable.

Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. 5 Steps to Write a Non-Profit Invoice Step 1. Voluntary donation A 50.

The next step is to verify that it has been applied to the invoice you created. Ad We Help You Make Small Business Invoicing Simple With Our Invoice Generator Software. Select Save and Close.

In the ProductService column select the Charitable Contributions item and enter the Amount of your donation as a positive number. Customize Your Invoice Add Your Logo and Personalize Your Thank You Email. Donation invoices also known as donation receipts provide proof of a charitable donation.

You can just create a general list of their contributions. The credit memo reflects the amount of your donation. Donation receipts for donated vehicles work in two ways.

These receipts are also used for tax purposes by the organization. It should clearly mention important items like the name of your charity with logo and address and the name of the donor and his contact details along with the date of the contribution by the donor. If the invoice is for merchandise it should be given out along with the order or send ahead of time for pre-payment if it is a large order.

192020 115650 AM. By providing receipts you let your donors know that their donation was received. So they get an itemized invoice for 150 and they can pay online as they would like to do.

Ask page visitors to donate. In the USA only 501 c 3 registered charity can be considered as tax-exempt such as private foundations and public charities. A donation receipt acts as a written record that a donor is given proving that a gift has been made to a legal organization.

These types of invoices for charitable giving are important for people who want to claim deductions on their tax returns. An invoice is a request for money owed after products are provided or when the performance of service has been completed. Charitable donation receipts are imperative documents especially for charity institutions because donations are non-deductible for the donors.

This is where you guide all potential donors found both on and offline and sell them on your organization or project. Add your name your organizations name if applicable and contact details to the top of the invoice Outline donations pledge or merchandise purchased plus a description and price for each Add your donors name business and contact details Add up the total of donations pledged and include in the Total section of the invoice. Ad Manage contracts created recurring invoices bill timesheets get paid faster with Odoo.

Other helpful details to include. Address the cause and ask page visitors to donate. But assuming they respond at all membership is also optional they may respond by only sending the 50 for the membership fee.

You will want to list the cash amounts donated as well as the type of products or services donated to your charity. Finally if the individual who made a donation and received goods and or services in exchange for any donation over 75. 2 if you end up using it you need to mention why youre doing so and how long you would in the donation receipt.

In the Memo field enter Donation or Charitable Contribution. Information covered by these types of invoices includes. The IRS is very particular as to what.

The name of an authorized representative of your organization and their signature. Donation receipts are also required when one individual donation adds up to 250 or more. A donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors.

Bill automatically based on sales orders delivery orders contracts or time material. 18 September 2016 at 717PM in Small biz MoneySaving. An ideal donation script should include definite information about the amount of donation and what the donor received in return.

A declaration that states if there were any commodities or services given in exchange for the donation. To do this make sure you include your charity information their name a summary of their contributions the total for their contributions and your signature. Voluntary donation B 50.

One of the processes newly in place was for a company to donate to us and as a thank you we list them in our brochure under a thank you to the following heading. A 501 c 3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. 1 If you sell the vehicle you need to mention the date of sale and the total profits that you made in the donation receipt.

Hiya Joined a small charity as a trusts fundraiser.

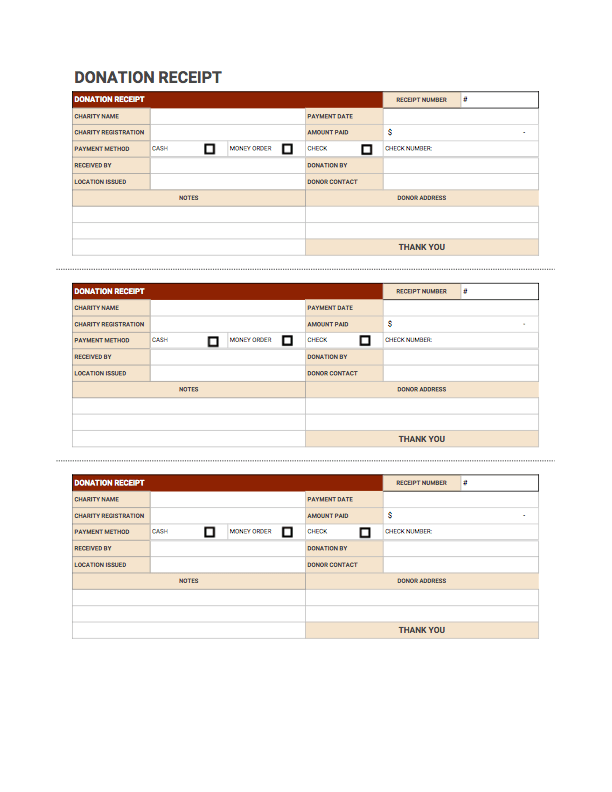

9 Charity Invoice Templates In Google Docs Google Sheets Excel Word Numbers Pages Pdf Free Premium Templates

Non Profit Invoice Template Free Downloadable Templates Freshbooks

10 Non Profit Invoice Templates Pdf Psd Google Docs Word Free Premium Templates

Free Donation Invoice Template Receipt Pdf Word Excel

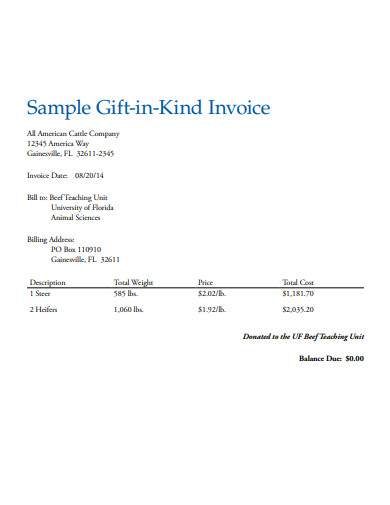

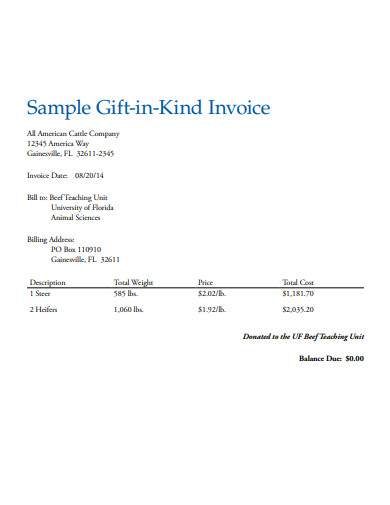

Free In Kind Personal Property Donation Receipt Template Pdf Word Eforms

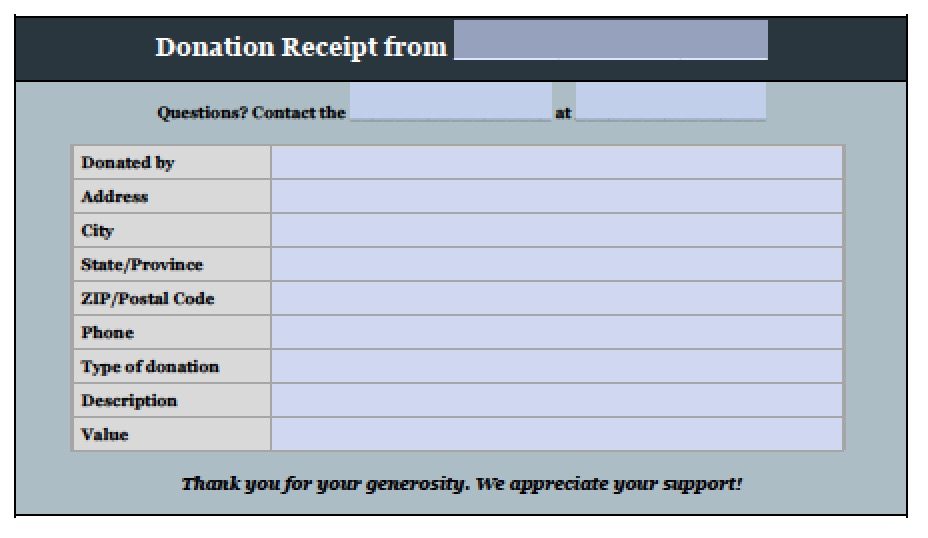

Donation Receipt Free Downloadable Templates Invoice Simple

10 Non Profit Invoice Templates Pdf Psd Google Docs Word Free Premium Templates

Post a Comment

Post a Comment